Can Everyone Please Stop Being Stupid About Who Pays Tariffs?

It's so painful

Epistemic status: rant.

I know little enough about economics to never be able to figure out who is right when serious economists disagree, but enough to be annoyed whenever a politician speaks. God, it’s so painful to listen to politicians talk. They endlessly go on about creating jobs, even though job creation is obviously not what we should be aiming at (you could create a bunch of jobs by paying people to dig holes, but that wouldn’t be good. What matters is boosted productivity, not how many people have jobs, especially when unemployment is very low).

But my irritation reaches its apex when I hear people argue about tariffs. It is bad enough hearing morally cretinous, economically illiterate politicians talk about the alleged benefits from tariffs. Crucial economic decisions that impact billions of people are being made by people who couldn’t draw a supply and demand curve, much less show you the standard economic impact of tariffs on a supply and demand curve. We have a president who makes major decisions about tariffs without knowing what the phrase “deadweight loss” means, which would be a bit like if the doctor performing your colonoscopy was neither aware of its downsides nor the standard reasons why it shouldn’t be carried out willy-nilly.

If you ever want to kill an economist without facing legal liability, just play them a clip of Trump talking about the economy, and he will keel over dead, blood pouring out of all his orifices. It is notable that there are only two economists in the world who support the Trump tariffs, and both are Peter Navarro.

But it isn’t just tariff supporters. Watch any interview with tariff opponents and they will ask “but aren’t the tariffs paid by Americans?” This is seen as some kind of devastating gotcha—as if it matters whether the tariffs are paid by the producers or consumers. This makes the angels cry.

I mean, first of all, the main concern about tariffs isn’t that they impose taxes on Americans. That’s true of all taxes the government imposes. It’s that they’re specifically distortionary because, by targeting specific transactions, they lead to parties not engaging in mutually beneficial purchasing decisions. The reason to oppose tariffs isn’t “Americans pay the taxes,” it’s “they’re wildly distortionary.”

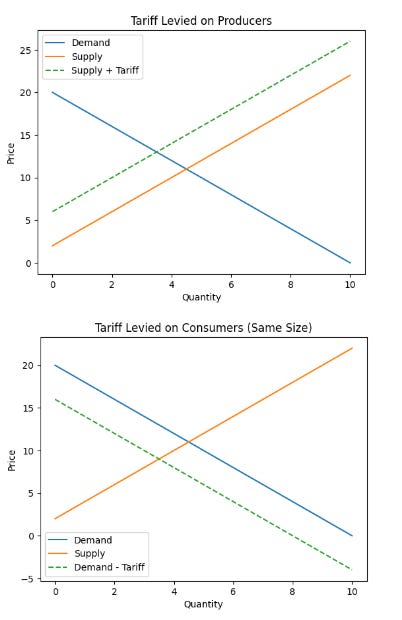

But it doesn’t matter who pays the tariff. The effect is the same regardless of who pays the tariffs. If producers have to pay a dollar every time they sell you an apple, they will raise prices. They won’t raise prices by a full dollar, because they’ll generally cut back production too, but if they pay money every time they sell you stuff, they’ll need more money to sell you stuff. The impacts are exactly the same regardless of whether producers or consumers pay.

Don’t believe me? Well, here is what the Wikipedia page on tax incidence says (and you can find similar sentiments articulated in intro econ textbooks):

Consider the case when the tax is levied on consumers. Unlike when tax is imposed on producers, the demand curve shifts to the left to create new equilibrium with initial supply (marginal cost) curve. The new equilibrium (at a lower price and lower quantity) represents the price that producers will receive after taxation and the point on the initial demand curve with respect to quantity of the good after taxation represents the price that consumers will pay due to the tax. Thus, it does not matter whether the tax is levied on consumers or producers.

If the tariff is imposed on producers, it shifts the supply curve upward. If it’s imposed on consumers, it shifts the demand curve downwards. Total cost paid by consumers is the same.

In short, the tariff pushes the equilibrium over by an amount equal to the value of the tariff, whether imposed on consumers or producers. This imposes deadweight loss proportional to the value of the tariff. If a tariff of 50 cents was imposed, the deadweight loss would be all the interactions where consumers would have profited by less than 50 cents. Those would have benefitted both parties, and yet they just don’t happen.

Who bears the cost of the tariff is different from who pays the tariff. It can be that one party pays all of the taxes and that the other party bears the costs of the tariffs (if, e.g. demand is perfectly inelastic, and prices rise by an amount equal to the cost of the tariff).

Also, obviously in the real world both producers and consumers will pay some of the costs. It is both true that costs will rise for consumers AND that producing tariff goods will be less profitable. It’s an open empirical question who pays what share of the cost, but clearly both will pay some.

Now, I don’t have high expectations of politicians and political commentators. I don’t expect them all to be econ wizards. But it would be nice if the people talking loudly and publicly about who pays the cost of the tariffs would have basic, Wikipedia-level knowledge about the theory of who pays the costs of tariffs. It would be nice if politicians felt a need to acknowledge obvious truths about economics, and if denying obvious truths about economics was as taboo as denying heliocentrism.

This isn’t as corrosive a falsehood as some that people have about tariffs. It’s a lot better for people to wrongly believe that tariffs are imposed on consumers if they physically pay the tax than it is for people to believe the more common myth, which is that tariffs are good. But still, it’s just so embarrassing.

The world is always stupider than you’d think. From first principles, you’d imagine near-universal opposition to tariffs. We aren’t lucky enough to get that. We aren’t even lucky enough to have people making the not obviously totally crazy arguments for tariffs—that they can prompt desirable short-run shifts, punish nefarious countries, and help national security. No, instead we get the world where what people are arguing about is who pays the tariff. That’s the world we get. Really? We get the world where people argue about some easily checkable fact, which isn’t what matters even if one cared about who bears the cost of the tariff, and who bears the cost of the tariff isn’t even the reason tariffs are bad!

May God have mercy on our souls.

Yes! It literally just shifts the supply curve! Both producers and consumers pay depending on the elasticity of demand and supply. I don’t know how economists bear the standard of public conversation about this sort of stuff. At least with philosophy the arguments people get tripped up over are usually somewhat hard and/or subtle.

There’s literally a simple picture that explains all of this!

"What matters is boosted productivity, not how many people have jobs, especially when unemployment is very low)."

OK, but *what if* productivity increases thanks to AI, but so does unemployment? Underneath the abstraction there are humans, and they get angry.